is idaho tax friendly to retirees

Other retirement income is taxed as regular income ranging from 2 to 5. Contents1 What are the benefits of.

State Taxes For Retirees Social Security Pensions Military

Idaho is tax-friendly toward retirees.

. Idaho Property Tax Breaks for Retirees For 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property tax reduction of up to 1500. Is Idaho Tax Friendly To Retirees. Social Security income is not taxed.

Retirement benefits Exemptions exist for some federal state and local pensions as well as. 800-352-3671 or 850-488-6800 or. Public and private pension.

Retirement income exclusion from 35000 to 65000. Depending on where you live when you retire you may have to pay all of these taxes or just a few. Is Idaho Tax Friendly To Retirees.

Taxes are inevitable in some form no matter if you are a civilian or military retiree or wherever you may live. Part 1 Age Disability and Filing. Social Security income is not taxedWages are taxed at normal rates and your marginal state tax rate is 590.

Withdrawals from retirement accounts are fully taxed. Idaho is one of the most tax-friendly states in the country for retirees. AL has state taxes ranging from 4 - 75 and property taxes that are some of.

Social Security income is not taxed. Idaho is tax-friendly toward retirees. Idaho property tax breaks for retirees for 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property tax.

Most pension benefits are currently taxable on your Idaho state income tax return. Contents1 What are the benefits of. Withdrawals from retirement accounts are fully taxed.

Idaho is tax-friendly toward retirees. Idaho is tax-friendly toward retirees. Idaho does not currently tax Social Security benefits as of 2021.

Social Security income is not taxed. Idaho property tax breaks for retirees for 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property tax. Wages are taxed at normal rates and your marginal state.

This is why if you are a retiree with a fixed income you might. Social Security income is not taxed. Property taxes are also very reasonable and there are a.

Does Idaho tax pension benefits. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. While potentially taxable on your federal return these arent taxable in Idaho.

404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes. Withdrawals from retirement accounts are fully taxed. There is no state income tax and the sales tax is relatively low.

Idaho Retirement Tax Friendliness Smartasset

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho Retirement Tax Friendliness Smartasset

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

Idaho Retirement Tax Friendliness Smartasset

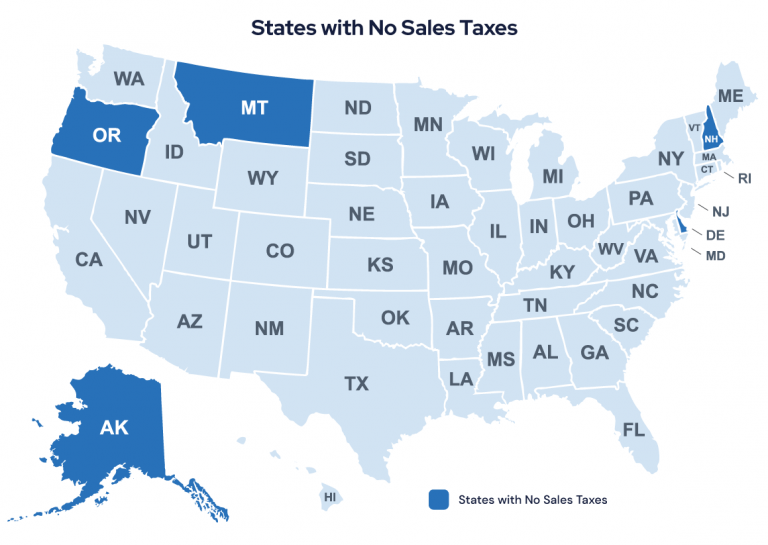

States That Don T Tax Retirement Income Personal Capital

Map Of The Worst States In America American History Timeline States In America Life Map

Finding A Tax Friendly State For Retirement Wolters Kluwer

Idaho State Tax Guide Kiplinger

Fold Out Road Maps Road Trip Planning Idaho Trip

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

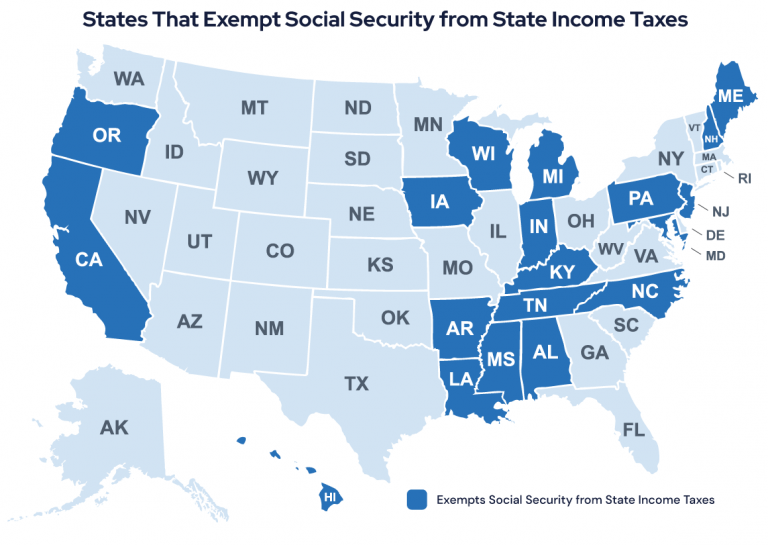

37 States That Don T Tax Social Security Benefits The Motley Fool

This Map Shows Where The Most Debt Burdened People In America Live Map Student Loans Debt

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

State Taxes For Retirees Social Security Pensions Military

State Taxes For Retirees Social Security Pensions Military

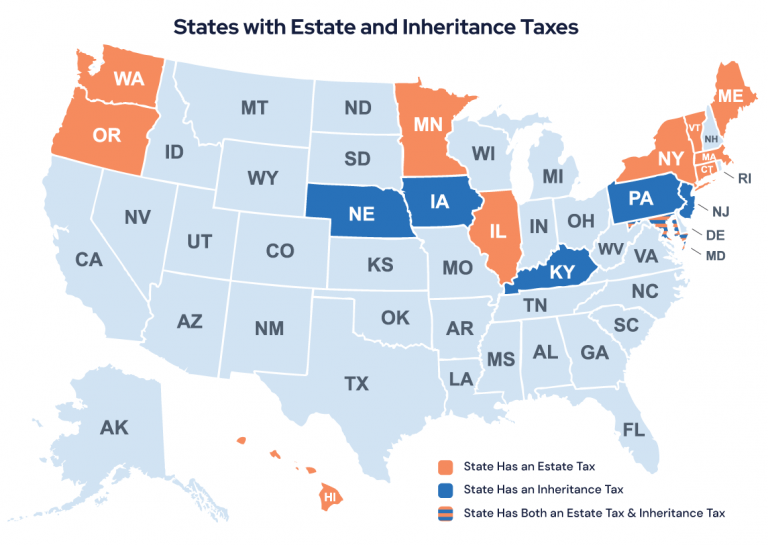

State By State Guide To Taxes On Retirees Inheritance Tax Best Places To Retire Tax